The Zong Family Trust Dispute: Jurisdiction, Confusion, and Lessons for Global Families

Boreal Editors’ Commentary

Introduction

For many ultra-high-net-worth families, establishing a trust has become as much a statement of status as it is a legal tool — much like acquiring an Hermès Birkin bag. It’s rare, it’s prestigious, and it signals sophistication.

For families with modest assets, this mindset might not cause too much harm. But for an empire-level fortune, treating a trust as a mere symbol — a shiny accessory — instead of a carefully governed structure can lead to disaster.

The ongoing dispute within the Zong family — heirs to one of China’s largest beverage empires — is a cautionary tale of what happens when trust planning is superficial, unclear, or misunderstood.

Case Study: The Zong Family Dispute and the Cracks in Offshore Planning

In 2025, a $2.1 billion inheritance battle broke out between 宗馥莉 (Kelly Zong), heiress of Wahaha and daughter of the late founder 宗庆后, and three claimants — Jacky, Jessie, and Jerry Zong — who say they are her half-siblings.

The plaintiffs allege that their father created three trusts for them, each worth $700M, funded at HSBC Hong Kong. They further claim Kelly improperly withdrew ~$1.1M from the trust account and is blocking them from receiving their rightful shares.

Kelly denies any knowledge of these trusts, denies receiving instructions from her father, and denies having authority to manage the HSBC account. The plaintiffs are seeking to freeze the account and stop Kelly from dealing with the funds.

What is striking is not just the size of the fortune at stake — but the contradictions at the heart of the story.

The Confusion & Questions Raised

This case lays bare the confusion that arises when families fail to clearly define roles, responsibilities, and documentation.

Several critical questions emerge:

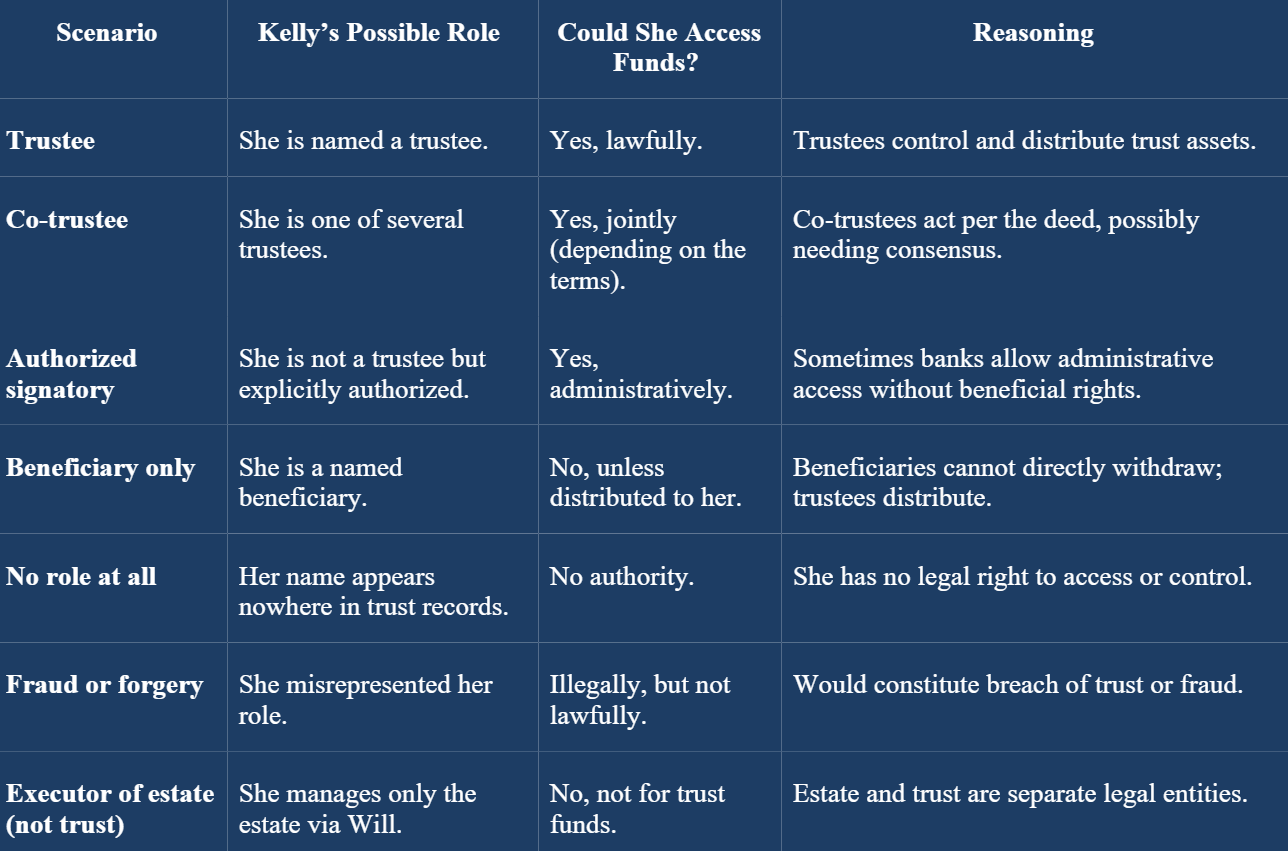

Who is the trustee? Who is the beneficiary? Who is the heir?

If Kelly is not the trustee or authorized signatory, she cannot legally withdraw or control trust assets.

If she did withdraw funds, then she must have been trustee or otherwise given access — which directly contradicts her claim of ignorance.

If the trust exists, it wouldn’t appear in the Will, because it would have been settled during her father’s lifetime — keeping both the assets and beneficiaries confidential, as is standard in offshore planning.

Without clear documentation — trust deed, account records, trustee appointment — the plaintiffs’ claims remain speculative and weak.

The answers lie in the misunderstood mechanics of trusts, and the dangerous assumptions families make when wealth, secrecy, and succession collide.

A trust created during Zong Qinghou’s lifetime wouldn’t appear in his Will. That’s normal—it means the assets were transferred while he was alive, and thus no longer legally part of his estate.

This is not an omission. It’s intentional. It’s one of the most common features—and benefits—of trusts: confidentiality. By design, living trusts operate quietly, outside of the public spotlight. But that very feature can turn into a liability when clarity is lacking.

Had the trust been testamentary—created by the Will—it would have been explicitly documented. But that’s not the plaintiffs’ claim. They say Zong established the trust during his lifetime—making it invisible in the estate process, and now, nearly invisible in the courts.

The Jurisdiction Trap

Beyond the internal confusion, the Zong case highlights another often-overlooked risk: jurisdictional conflict.

Here, the trusts are allegedly governed by Hong Kong law, held at HSBC Hong Kong, while the heirs reside in mainland China — where separate litigation is ongoing with legal standards, evidentiary rules, and cultural expectations around family, inheritance, and privacy sharply diverge.

At one hearing, the Hong Kong judge himself expressed concern that his injunction might conflict with proceedings in Hangzhou. Without a clear designation of governing law, jurisdiction, and forum in the trust documentation, such cross-border disputes become inevitable.

This isn’t just a family drama—it’s a collision of legal systems.

What’s standard fiduciary discretion in Hong Kong might appear as misappropriation in Hangzhou. What one court sees as due process, another might call secrecy. And in this crossfire, the burden of proof shifts like sand.

Understanding Trust Roles: Not Just Paper

At Boreal, we often see families conflating the distinct roles involved in trust planning — a mistake that leads to exactly the kind of chaos seen in the Zong dispute.

Here are the key roles:

Trustee: Controls and manages the trust property according to the deed.

Beneficiary: Entitled to benefit, but cannot control or withdraw funds.

Heir: Inherits estate property, not trust assets.

Executor: Administers the estate — separate from trust administration.

If these roles are misunderstood or conflated, family members may act beyond their authority, or feel entitled to rights they do not have.

Trusts are not static pieces of paper to file away. They are living governance structures requiring clarity of intention, well-defined roles, and ongoing care.

Insight from Boreal: Clarity Is the Greatest Inheritance

This case reveals more than family tension—it exposes the vulnerabilities of offshore wealth when trust structures are vague, opaque, or undocumented.

Families often create trusts to shield wealth from legal risk, political instability, or even tax exposure. But they sometimes forget the most basic rule of legacy planning: trusts don’t run on secrecy—they run on clarity.

When you move assets across borders, you also cross legal cultures. What feels “normal” in Hong Kong might look suspicious in Hangzhou. What is standard fiduciary discretion in Jersey might look like misappropriation in Canada.

At Boreal, we help families build structures that not only hold wealth but withstand pressure, conflict, and time. Because when your legacy spans continents, it can’t afford to be fragile. It must be clear, documented, and governed—like the vessel it is.

When a family trust collapses under scrutiny, it’s never just the money that’s lost. It’s confidence. It’s trust itself.

Let’s build better.

信托不只是纸面游戏:为什么流程与人员同样重要 —— 从宗氏家族案例看教训

Boreal 编辑部评论

引言

对于许多超高净值家庭而言,设立信托既是一种法律工具,也是一种地位的象征 —— 就像拥有一只爱马仕柏金包一样。它稀有、它体面、它彰显精致。

对于资产较为普通的家庭,这种心态或许不会造成太大伤害。但对于一个帝国级财富而言,将信托视为一种光鲜的摆设,而不是一个经过精心治理的架构,可能会带来灾难。

宗氏家族——中国最大饮料帝国之一的继承人之间的持续纷争,就是一个警示:当信托规划流于表面、含糊不清或被误解时,会发生什么。

案例分析:宗氏家族纷争与离岸规划的裂缝

2025年,一场价值21亿美元的继承之争爆发,争斗双方是娃哈哈创始人宗庆后的女儿、继承人宗馥莉(Kelly Zong),以及自称是她同父异母兄弟姐妹的三位原告——Jacky、Jessie 和 Jerry Zong。

原告声称,他们的父亲曾为他们各自设立了三个信托,每个价值7亿美元,资金存放在汇丰香港。他们进一步指控Kelly不当提取了约110万美元的信托账户资金,并阻碍他们领取应得的份额。

Kelly 否认知情、否认收到父亲的任何指示,也否认有权管理该汇丰账户。原告则申请冻结账户并阻止她继续操作资金。

引人注目的不仅仅是巨额财富本身,而是故事背后的重重矛盾。

暴露的困惑与疑问

本案揭示了当家族未能清晰界定角色、责任与文件时,会引发的混乱。

几个关键问题浮出水面:

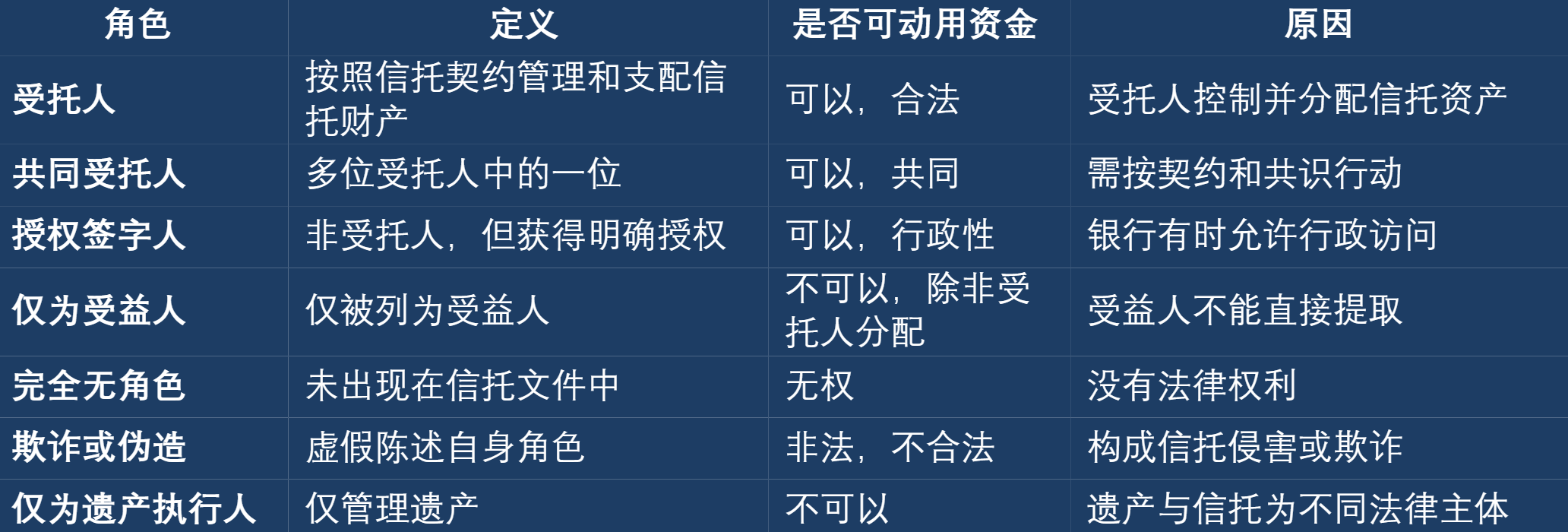

谁是受托人?谁是受益人?谁是继承人?

如果Kelly不是受托人或授权签字人,她在法律上不能提取或控制信托资产。

如果她确实提取了资金,那她必然是受托人或获得了授权,这与她声称的“毫不知情”直接矛盾。

如果信托真实存在,它不会出现在遗嘱中,因为它是在其父亲生前设立的,这正是离岸规划的常态:资产和受益人均保持机密。

缺少明确的文件——如信托契约、账户记录、受托人任命书——原告的指控就显得推测性强且脆弱。

答案隐藏在对信托机制的误解,以及财富、隐秘与继承冲突时的危险假设之中。

宗庆后生前设立的信托不会出现在遗嘱里,这很正常——这意味着资产在他在世时已转移,因此不再属于遗产。

这不是疏漏,而是有意为之。这是信托最常见、最重要的特征之一:保密性。按照设计,生前信托悄然运作,不受公众注视。但当缺乏清晰度时,这一特性也可能成为隐患。

如果是遗嘱信托,就会在遗嘱中明示。但原告称的是生前信托——这使得它在遗产程序中“隐身”,如今在法庭上也几乎不可见。

司法辖区的陷阱

除了内部混乱,宗氏案例还突显了另一个经常被忽视的风险:司法冲突。

此案中,信托据称受香港法律管辖,资金存于汇丰香港,而继承人居住在中国大陆——两地正在分别进行诉讼,法律标准、证据规则、对家族、继承及隐私的文化期待都截然不同。

在一次听证会上,香港法官本人甚至担忧,他的禁令可能与杭州的诉讼程序冲突。若信托文件中未明确指定管辖法律、司法管辖地和审理法院,这种跨境纠纷几乎不可避免。

这不仅仅是一出家族剧,更是法律体系的正面冲突。

在香港看似合理的受托人裁量权,在杭州可能被视为侵吞;在一个法院看来是正当程序,另一个可能称之为隐匿;而在这种交锋中,举证责任也如同流沙般变化。

理解信托角色:不仅仅是纸上文字

在Boreal,我们常常看到家族混淆信托规划中的不同角色,这种错误恰恰导致了宗氏纠纷中的混乱。

以下是关键角色:

信托不是静态的纸面文件。它是一个活的治理架构,需要清晰的意图、明确的角色和持续的维护

Boreal 洞察:清晰是最好的遗产

此案不仅揭示了家族矛盾,还暴露了当信托架构模糊、晦涩或缺乏文件化时,离岸财富的脆弱性。

家族常常设立信托以规避法律风险、政治不稳甚至税务压力。但他们有时忘记了遗产规划中最基本的规则:信托依靠的不是隐秘,而是清晰。

当你把资产跨境转移时,也跨越了法律文化。在香港看似“正常”的做法,在杭州可能显得可疑;在泽西岛看似标准的裁量,在加拿大可能被视为侵占。

在Boreal,我们帮助家族打造的不仅是持有财富的架构,更是能够经受压力、冲突与时间考验的架构。因为当你的遗产横跨多个大陆,它不能脆弱。它必须清晰、文件化、治理良好 —— 像一艘真正的船。

当一个家族信托在审查下崩塌时,失去的不只是金钱。更是信任本身。

让我们一起,建设得更好。