2025 Market Review and 2026 Investment Outlook

The year 2025 was defined by structural shifts rather than short-term cycles. Geopolitical realignment, persistent inflationary undercurrents, rapid advances in artificial intelligence, and continued monetary accommodation across major economies shaped asset prices globally. While markets delivered uneven returns, the broader picture was one of resilience (particularly in the United States) alongside rising valuation risks and growing dispersion among asset classes.

As we look ahead to 2026, investors face a familiar but intensifying challenge: how to participate in growth while managing elevated systemic and valuation risks.

2025 Market Performance Review

The S&P 500 delivered another strong year in 2025, driven primarily by large-cap technology, AI-related infrastructure providers, and platform companies with dominant market positions. Earnings growth remained concentrated, with a narrow group of companies accounting for a disproportionate share of index gains.

Despite periodic volatility linked to interest-rate expectations and geopolitical headlines, U.S. equities continued to outperform most global peers. However, valuations expanded further, with forward price-to-earnings multiples remaining well above long-term averages, increasing the market’s sensitivity to earnings disappointments or policy shocks.

Fixed income markets experienced stabilization after the volatility of prior years. U.S. Treasury yields peaked earlier in the cycle and gradually trended lower or remained range-bound through 2025. This provided modest capital appreciation for duration-sensitive assets while restoring income generation as a meaningful component of total returns.

Investment-grade credit performed steadily, while high-yield bonds benefited from resilient economic growth and low default rates. Fixed income increasingly reasserted its role as a portfolio stabilizer rather than merely a source of volatility.

Gold emerged as one of the strongest strategic performers in 2025. Persistent geopolitical tensions, rising sovereign debt levels, and synchronized monetary easing across multiple regions supported demand from both institutional and central bank buyers.

Silver and copper also gained traction, driven by industrial demand linked to electrification, renewable energy, and AI-related infrastructure. Precious and industrial metals increasingly function as both inflation hedges and long-term strategic assets.

Bitcoin continued to mature as a macro-sensitive asset. While volatility remained high, institutional participation expanded, and Bitcoin increasingly traded as a hedge against currency debasement and sovereign risk rather than as a purely speculative instrument. That said, the digital asset market remained highly sentiment-driven, with sharp drawdowns following regulatory developments or shifts in liquidity conditions.

Private equity faced a more challenging environment in 2025. Elevated interest rates earlier in the year constrained leverage, slowed deal activity, and pressured exit valuations. While operational improvements remained a source of value creation, fundraising became more selective, and dispersion among managers widened significantly.

Real estate markets remained bifurcated. Residential real estate stabilized in many regions as interest rates plateaued, while commercial real estate (particularly office space) continued to face structural headwinds. Logistics, data centers, and specialized residential segments showed relative strength.

Emerging markets delivered mixed results. Countries aligned with supply-chain diversification trends, particularly in Southeast Asia, attracted increasing foreign direct investment. However, currency depreciation and capital-flow volatility limited equity market performance in several regions.

Japan’s move toward interest rate normalization represents a structural policy shift that may strengthen the yen and create near-term equity volatility but also reflects improving domestic fundamentals and supports healthier long-term capital allocation. Europe, by contrast, struggled with slower growth, energy constraints, and fiscal fragmentation, resulting in underperformance relative to the U.S. and Japan.

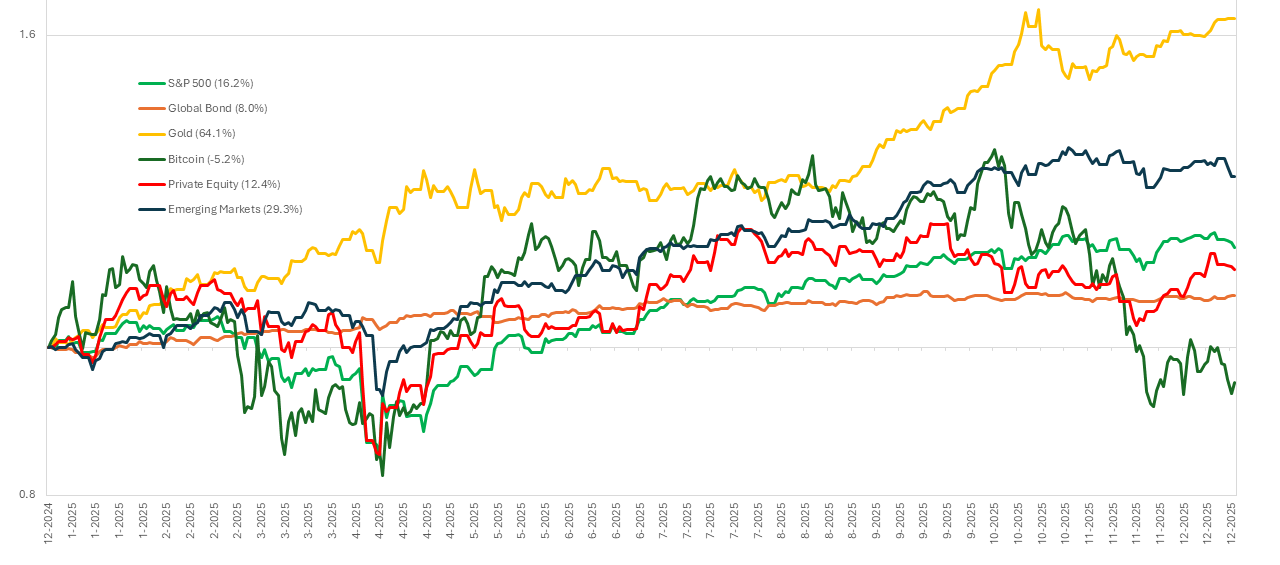

2025 YTD Major Asset Class Returns

Source: Boreal Family Office, Ycharts

2026 Outlook: Key Themes and Opportunities

U.S. Interest Rates and Economic Growth

Looking ahead to 2026, we expect U.S. interest rates to remain stable or gradually decline. This reflects moderating inflation, policy support aimed at economic resilience, and the need to offset the negative effects of prolonged trade frictions.

The U.S. economy is likely to remain the strongest among major economic blocs, supported by innovation leadership, labor market flexibility, and capital market depth.

U.S. Equities

U.S. equities are expected to continue benefiting from AI-driven productivity gains. However, the risk profile is changing. While AI represents a genuine technological revolution, asset prices increasingly reflect optimistic assumptions about monetization, scalability, and market dominance.

We believe the AI theme is not a short-term fad, but valuations in certain segments suggest bubble-like characteristics. Investors should expect higher volatility, sharper drawdowns, and increased differentiation between winners and losers.

China–U.S. Trade Dynamics

Trade friction between China and the United States is unlikely to disappear. Instead, it is expected to persist or escalate through alternative channels such as technology controls, capital restrictions, and supply-chain realignment.

The U.S. will likely continue supporting Southeast Asia as a manufacturing and logistics alternative to China, accelerating capital flows into countries such as Vietnam, Indonesia, and India.

Global Currency Debasement and Commodities

One of the most underappreciated trends is global monetary accommodation. With nearly all major economies maintaining loose monetary conditions, currency depreciation is becoming a shared global phenomenon rather than a localized risk.

In this environment, real assets such as gold, silver, and copper offer a compelling long-term value. These assets serve both as inflation hedges and as beneficiaries of structural demand tied to energy transition and digital infrastructure.

Conclusion

As we enter 2026, the investment landscape is characterized by strength, imbalance, and transition. The U.S. remains the most resilient economic engine, AI continues to reshape productivity, and real assets gain importance amid global monetary easing.

However, elevated valuations, geopolitical fragmentation, and technological concentration require a disciplined and diversified approach. Successful investors will balance growth exposure with real assets, income-generating securities, and selective global diversification. It is best to recognize that opportunity and risk are increasingly inseparable.

*Disclosure: This material is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to purchase or sell any securities. This commentary is only a synthesis which does not provide the full picture. Reliance on the information provided herein is at the sole discretion of the reader.

Investing involves risks, and you should always seek the help of a qualified financial professional for personalized advice tailored to your individual circumstances and risk tolerance. The opinions expressed are subject to change without notice. This information is not intended to be complete or exhaustive, and no representations or warranties, either express or implied, are made regarding its accuracy or completeness. This material may contain estimates and forward-looking statements that are not a guarantee of future performance.

2025 年市场回顾与 2026 年投资展望

一、执行摘要(Executive Summary)

2025 年的全球资本市场并非由短期周期性波动所主导,而是深刻反映出一系列结构性转变:地缘政治格局重塑、通胀黏性持续、人工智能对生产力的系统性影响,以及主要经济体在财政与货币政策层面展现出的高度协调性。

尽管不同资产类别之间的回报差异显著,但整体市场展现出一定韧性,尤其以美国资产表现最为突出。然而,这种韧性是在估值抬升、集中度加剧和潜在尾部风险累积的背景下实现的。展望 2026 年,投资者的核心挑战在于:如何在参与长期增长趋势的同时,审慎管理估值风险与宏观不确定性。

二、2025 年主要资产类别回顾

1. 美国股票市场

2025年,美国股市延续强势表现,标普 500 指数的回报主要由少数大型科技企业及人工智能相关产业链公司驱动。盈利增长呈现高度集中化特征,市场对龙头企业的依赖程度显著高于历史平均水平。

尽管市场在年内多次受到利率预期调整及地缘政治事件的扰动,但整体趋势仍保持上行。然而,当前估值水平已明显高于长期均值,使市场对盈利下修、政策变化或流动性冲击的敏感性显著提升。

2. 固定收益市场

在经历此前数年的剧烈波动后,固定收益市场于 2025 年逐步企稳。美国国债收益率在触及阶段性高点后趋于区间运行,为久期资产带来一定资本利得空间,并重新确立了债券在组合中作为收益来源与风险缓冲器的角色。

投资级信用债表现稳健;高收益债券则受益于相对健康的宏观环境及低违约率,但其风险溢价已明显压缩。

3. 贵金属与大宗商品

黄金成为 2025 年最具战略意义的资产之一。持续的地缘政治紧张、主权债务水平上升以及全球主要央行同步转向宽松立场,共同推动了央行与机构投资者对黄金的配置需求。

与此同时,白银和铜等工业金属在电气化、可再生能源建设及人工智能基础设施投资推动下亦表现强劲,兼具通胀对冲与长期结构性需求属性。

4. 数字资产

数字资产市场延续高波动特征,但机构参与度持续上升。比特币正逐步被部分投资者视为对冲货币贬值和主权风险的另类资产,而不仅是短期投机工具。

然而,监管不确定性、流动性变化及情绪驱动因素仍使该资产类别的风险水平维持在高位。

5. 私募股权

私募股权在 2025 年面临较为复杂的环境。高利率水平在年初抑制了杠杆使用和交易活动,并对退出估值形成压力。价值创造更多依赖于运营改善而非多重扩张,管理人之间的业绩分化明显扩大。

6. 房地产

房地产市场呈现高度分化格局。住宅地产在利率趋稳后逐步企稳;而办公地产等传统商业地产则继续承压。物流设施、数据中心及部分住宅细分市场表现相对稳健。

7. 国际与新兴市场

新兴市场整体表现不一。受益于供应链重构的东南亚部分国家吸引了持续资本流入;但汇率波动及资本流动不稳定性仍限制部分市场表现。

日本在多年后开启利率正常化进程,反映出国内基本面改善,但短期内可能加剧市场波动。欧洲则因增长乏力、能源约束及财政分化问题,整体表现相对滞后。

三、2026 年展望:关键主题

1. 利率环境与美国经济

预计美国利率将在 2026 年维持高位稳定或逐步下行,反映通胀压力缓和及政策对经济韧性的支持。相较其他主要经济体,美国仍具备创新能力、资本市场深度及制度灵活性等结构性优势。

2. 美国股市前景

人工智能驱动的生产力提升仍将是中长期核心主题,但市场已开始区分“技术趋势”与“资产价格合理性”。预计波动率上升、回调幅度扩大,以及行业与公司之间的分化将成为常态。

3. 中美关系与全球供应链

中美关系预计将以非关税形式持续演变,包括技术限制、资本流动管理及供应链重构。美国对东南亚及印度等地区的战略性投资预计将进一步加速。

4. 货币贬值与实物资产配置

在全球主要经济体普遍采取宽松政策的环境下,货币贬值风险呈系统性特征。实物资产,尤其是贵金属及受益于能源转型和数字化基础设施的资源类资产,仍具备重要的战略配置价值。

四、结论

迈入 2026 年,全球投资环境呈现出韧性、失衡与转型并存的特征。美国仍是全球最具韧性的增长引擎,人工智能持续重塑经济结构,而实物资产在宏观不确定性加剧的背景下地位提升。

然而,高估值、地缘政治分裂及技术集中度风险要求投资者采取审慎、分散且具前瞻性的资产配置策略。长期成功的投资组合,应在增长、收益、实物资产及全球多元化之间实现平衡。

*披露声明:本资料仅供信息参考之用,不构成投资建议、任何形式的推荐,亦不构成购买或出售任何证券的要约。本评论内容仅为综合整理,未能反映全部情况。读者如依据本文信息作出任何决定,相关责任完全由读者自行承担。

投资具有风险,您应始终寻求具备资质的金融专业人士,根据您的个人情况及风险承受能力提供定制化建议。本文所表达的观点可能在不另行通知的情况下发生变化。本资料并非完整或穷尽性的陈述,对于其准确性或完整性,不作任何明示或默示的陈述或保证。本资料可能包含估计性内容及前瞻性陈述,且不构成对未来业绩的任何保证。