CRM3: The First Time Your Investment Fees Are Explained

For years, investors were told that fees were “disclosed,” yet very few could answer a simple question with confidence: How much am I actually paying to invest, and how does it affect my returns?

Introducing: CRM3 (Client Relationship Model Phase 3). This is the regulator’s response to that gap.

CRM3 builds on CRM2 by introducing Total Cost Reporting (TCR). Its purpose is straightforward but long overdue: to show investors the full cost of owning investment funds, not just the visible fees paid to dealers, but also the embedded costs quietly deducted inside products year after year.

Total Cost Reporting (TCR) applies to publicly offered investment funds, such as mutual funds and ETFs distributed under a prospectus. It does not apply to private placements, structured products, labour-sponsored investment funds, or other non-public investments. As a result, the full cost transparency introduced under CRM3 may not be available for these types of investments, and investors should exercise additional diligence when evaluating their fees and value.

At Boreal, we strongly support CRM3. Not because it adds paperwork, but because it adds truth. Transparency is not a burden to good investment processes it is a stress test that exposes weak ones.

On Jan. 1, 2026, investment companies will start collecting data on all embedded investment costs for investment funds and segregated funds.

Beginning in early 2027 (for the 2026 calendar year), investors will receive annual reports that reflect the true economic cost of their portfolios and the real impact of fees on net returns.

What is FER: The Missing Half of the Fee Conversation

One of the most important changes under CRM3 is the introduction of the Fund Expense Ratio (FER).

Historically, investors were shown the Management Expense Ratio (MER). While useful, MER was incomplete. It excluded the cost of trading activity inside the fund costs that directly reduce returns but were largely invisible to clients.

FER closes that gap.

FER represents the total percentage of a fund’s assets used to cover all operating expenses, and it consists of two components:

MER (Management Expense Ratio)

Covers management fees, advisory or trailer fees (where applicable), fund operating costs, and taxes.

TER (Trading Expense Ratio)

Reflects the cost of buying and selling securities within the fund, including commissions and certain derivative-related costs.

Put simply:

MER + TER = FER

FER does not introduce new fees. It reveals fees that already existed.

This distinction matters. Trading activity is a real economic decision. High turnover can be justified in some strategies and unjustifiable in others. Under CRM3, investors will finally see whether trading intensity aligns with results or merely inflates costs.

How CRM3 Differs from CRM2

CRM2 was an important step, but it focused primarily on investment dealer compensation: what investors paid to advisors and dealers.

CRM3 goes further by addressing product economics: what investors pay inside the investment itself.

Under CRM3:

Cost reporting expands from direct fees to total costs, including embedded fund expenses.

Reports will show:

Total dollar cost of fund ownership

Fund Expense Ratio (FER) for each fund held

The impact of fees on portfolio returns

A new Product Fee Report is added alongside existing performance and compensation reports.

In short, CRM2 told you who got paid.

CRM3 tells you how much investing actually cost.

How Will You Be Impacted?

For clients, CRM3 changes the quality of the conversation.

You will see:

Higher reported fee numbers not because fees increased, but because previous reporting was incomplete

Clear linkage between costs and performance

Standardized, comparable disclosures across funds and platforms

This clarity will feel uncomfortable for parts of the industry. That is precisely why it matters.

Transparency forces accountability. It separates:

Strategies that are expensive but justified, from

Products that are cheap in value but rich in intermediaries

At Boreal, we believe investors deserve to see both sides of that equation.

The Question That CRM3 Forces Us to Ask

CRM3 does not tell you what to invest in. It tells you what to question.

Are the investment services you’re paying for worth their fees?

Some are.

Sophisticated portfolio construction, disciplined risk management, institutional-quality implementation, and genuine advisory work can justify their cost.

Others are not investments at all — they are distribution machines, optimized to extract recurring revenue while delivering little structural advantage to the client.

CRM3 does not make that judgment for you.

It gives you the data to make it yourself.

And that is why we support it.

Because durable wealth is not built by hiding costs. it is built by understanding them, challenging them, and ensuring every dollar paid has a reason to exist.

Appendix

This is where investment fee discussions often become confusing. Many terms sound similar but mean very different things depending on the fund structure and pricing model. Understanding these distinctions highlights the importance of CRM3.

What is a Management Fee?

The management fee is set by the investment fund manufacturer, but what it includes depends on the fund series.

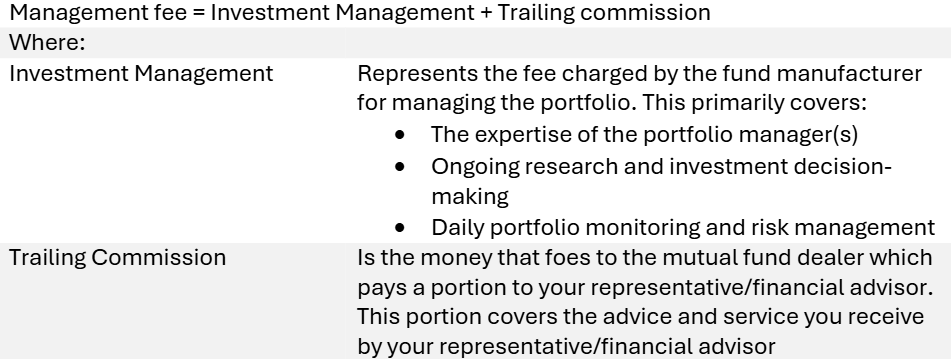

For commission-based fund series

In this structure, the advisor is compensated indirectly through the fund.

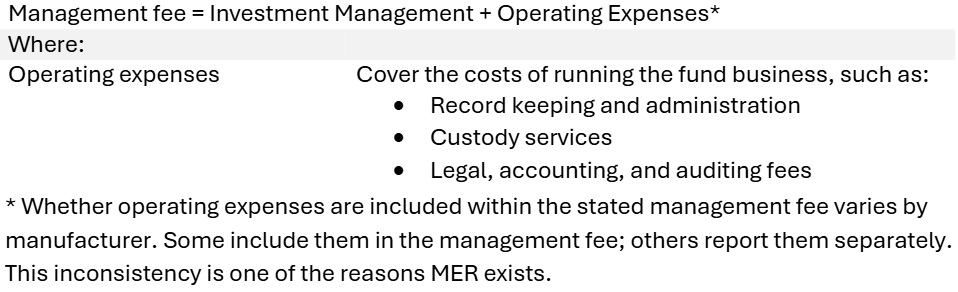

For fee-based fund series

No trailing commission is included in the management fee

The advisor charges a separate, explicit account fee directly to the client, as agreed in advance

* Whether operating expenses are included within the stated management fee varies by manufacturer. Some include them in the management fee; others report them separately. This inconsistency is one of the reasons MER exists.

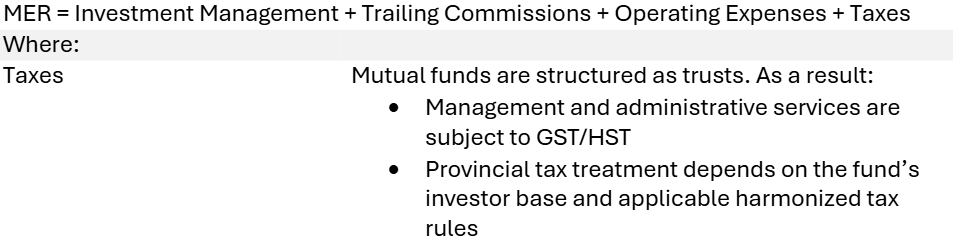

What is the MER?

To reduce confusion and improve comparability, the Management Expense Ratio (MER) was created. MER is designed to capture most of the ongoing costs of owning a mutual fund.

For commission-based fund series

For Fee-based fund series

Trailing commissions are excluded from the MER

Advisor compensation is charged separately as an account or advisory fee

This separation improves transparency and may offer tax efficiency, as advisory fees charged directly to the client may be tax-deductible in certain non-registered accounts. This is governed by paragraph 20(1)(bb) of the Income Tax Act.

MER = Investment Management + Operating Expenses + Taxes

What is in TER?

While MER is widely known, the Trading Expense Ratio (TER) has historically received far less attention.

TER represents the annual cost of trading activity inside the fund, incurred when the portfolio management team buys and sells securities.

TER includes:

Brokerage commissions

Certain transaction-related costs

Some derivative-related expenses (such as swap costs), where applicable

Important distinctions:

Bond funds typically do not report a TER, because bond trading costs are embedded in bond prices through bid-ask spreads

TER is most influenced by:

Trading frequency

Asset class mix

Fund inflows and outflows

Trading desk efficiency

Under CRM3, TER is no longer invisible it becomes part of the Fund Expense Ratio (FER), giving investors a clearer view of how trading decisions affect net returns.